Business Insurance in and around Eureka

One of the top small business insurance companies in Eureka, and beyond.

Cover all the bases for your small business

Your Search For Excellent Small Business Insurance Ends Now.

When experiencing the challenges of small business ownership, let State Farm do what they do well and help provide great insurance for your business. Your policy can include options such as business continuity plans, errors and omissions liability, and extra liability coverage.

One of the top small business insurance companies in Eureka, and beyond.

Cover all the bases for your small business

Small Business Insurance You Can Count On

Your company is special. It's where you earn a living and also how you build a life—for yourself but also for your loved ones, and those who work for you. It’s more than just a store or an office. Your business is an extension of yourself. Doing what you can to keep it safe just makes sense! That's why one of the most sensible steps is to get outstanding small business insurance from State Farm. Small business insurance covers many occupations like a pet groomer. State Farm agent Anthony Luster is ready to help review coverages that fit your business needs. Whether you are a fence contractor, an HVAC contractor or a drywall installer, or your business is a funeral home, a travel agency or a craft store. Whatever your do, your State Farm agent can help because our agents are business owners too! Anthony Luster understands the unique needs you have and is ready to review coverages that meet your needs. With State Farm, you’ll be ready to grow your business into a bright future.

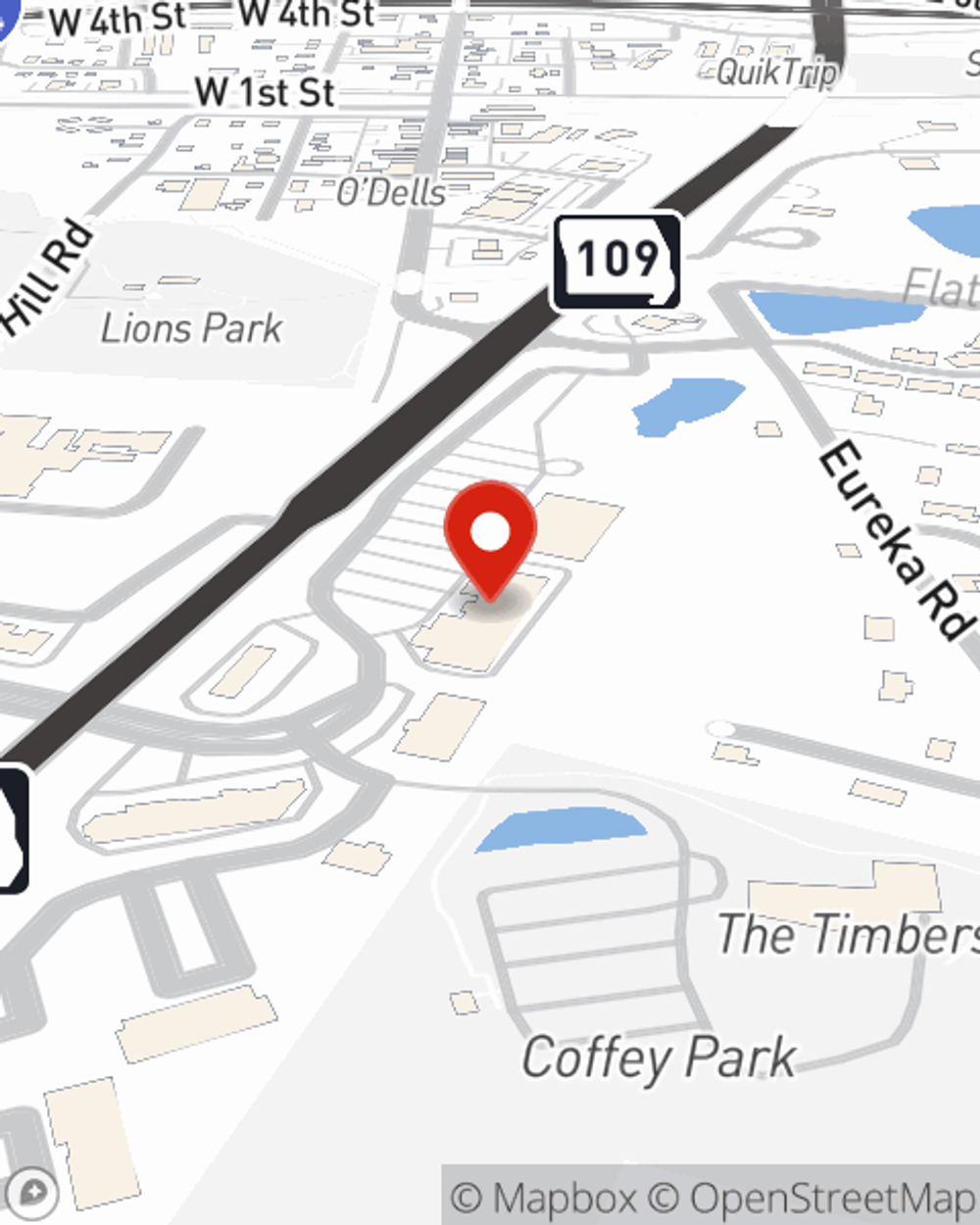

Ready to review the business insurance options that may be right for you? Stop by agent Anthony Luster's office to get started!

Simple Insights®

Before you rent, ask your landlord about move-costs and monthly bills due

Before you rent, ask your landlord about move-costs and monthly bills due

Rent, deposits and fees can sometimes get tricky if they haven't been discussed thoroughly with your landlord before signing a rental agreement.

Consider a Simplified Employee Pension plan for your small business

Consider a Simplified Employee Pension plan for your small business

Simplified Employee Pension IRA (SEP IRA) plans are employee IRAs funded by tax-deductible contributions from small business employers.

Anthony Luster

State Farm® Insurance AgentSimple Insights®

Before you rent, ask your landlord about move-costs and monthly bills due

Before you rent, ask your landlord about move-costs and monthly bills due

Rent, deposits and fees can sometimes get tricky if they haven't been discussed thoroughly with your landlord before signing a rental agreement.

Consider a Simplified Employee Pension plan for your small business

Consider a Simplified Employee Pension plan for your small business

Simplified Employee Pension IRA (SEP IRA) plans are employee IRAs funded by tax-deductible contributions from small business employers.